By Kuldip K. Ambastha

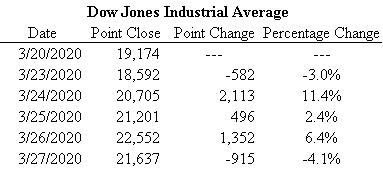

Per the table seen above, the Dow Jones Industrial Average (DJIA) took investors on a volatile ride this week. Down days were seen on Monday and Friday. Up days were seen on the Tuesday, Wednesday, and Thursday in between. This pattern in the DJIA was observed due to the federal government’s response to the coronavirus pandemic.

Even though two down days were seen, the DJIA posted its best weekly percentage gain since 1938. Initially, the U.S. Senate was expected, early in the week, to pass a $2 trillion stimulus package to deal with the coronavirus pandemic. However, the package was approved in the Senate on the night of Wednesday. Then, on Friday, the U.S. House of Representatives approved the package as well. Later in the day on Friday, President Donald J. Trump signed the coronavirus relief package. This series of events had a direct impact on the DJIA’s fluctuations.

On Monday, a down day was seen because people had hoped a package could have been finalized in the Senate on this day, but this did not happen. On Tuesday, hopes of a package coming together drove a strong gain. Tuesday’s gain was the biggest-ever one-day point and percentage gains since 1933, a day after hitting the lowest level since 2016. On Wednesday and Thursday, more modest gains were seen each day as the bill was discussed in the Senate and House. On Friday, the bill being passed and signed by the President was seen as positive, though this was also offset by a news report showing that U.S. consumer sentiment had fallen significantly. The whole world is still in uncharted territory due to the coronavirus pandemic. Week by week, a lot can change both in the USA and elsewhere.

Keywords – Dow Jones Industrial Average, Dow Jones, DJIA, government, stimulus, package, bill, coronavirus, COVID-19, pandemic, public health, trillion, Senate, House, consumer sentiment, President Donald J. Trump.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.