By Kuldip K. Ambastha

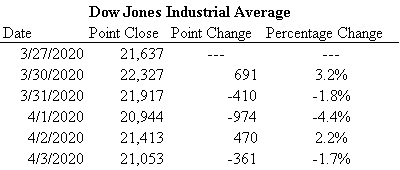

The Dow Jones was up and down this week day by day, similar to what has been seen in the past few weeks. Due to the coronavirus pandemic and its related public health concerns around the world, massive changes have been seen in the USA and these changes have been affecting the capital markets significantly. Specifically, data related to the American jobs and unemployment landscape has been quite negative, likely with more bad news to come in the following weeks.

Weekly jobless claims are reflecting massive damage from the coronavirus. Specifically, about 10 million American individuals filed the initial paperwork for unemployment insurance in the last two full weeks of March. This is a record that has led the Congressional Budget Office to state that the unemployment rate may soon be greater than 10% during 2Q2020, a figure which is higher than what occurred at any time during the global financial crisis (GFC). Companies across the board, whether small, medium, or large, have been announcing massive layoffs and furloughs, to cut costs as more and more people have to stay at home due to the coronavirus.

Globally, one million people have been infected by the coronavirus, with a death toll of above 55,000. In the USA, over 266,000 cases of infection have been identified as of the afternoon of Friday, April 3, 2020. Cases have been reported all over the USA, with a lot of attention focused on the state of New York which has been especially hit hard with over 100,000 cases of infection.

On Friday, April 3, 2020, the Department of Labor released an official jobs report with data through March 12th (before the USA mostly went into a lockdown mode because of the coronavirus). This report showed actual job loss data which was much more than expected. March’s change in non-farm payroll jobs was a loss of 701,000 vs. an expected figure of a loss of 100,000. March’s unemployment rate was 4.4% vs. an expected figure of 3.5%.

Given that the coronavirus pandemic is still present globally everywhere, no coronavirus vaccine has been developed as of yet, and social distancing measures may be in place for a while, it is fair to expect more negative data in the near future. This negative data will make for many more up and down days in the Dow Jones before stability can be achieved at an unknown future point in time.

Keywords – Dow Jones Industrial Average, Dow Jones, DJIA, data, jobs, unemployment, unemployment insurance, jobless claims, non-farm payroll, coronavirus, COVID-19, pandemic, public health, global financial crisis, GFC, layoffs, furloughs, costs, world, globe, New York, Congressional Budget Office, Department of Labor.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.