By Kuldip K. Ambastha

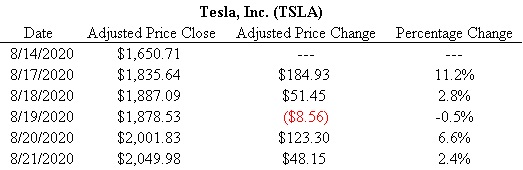

Tesla, Inc. (TSLA) had strong returns for four of the five trading days of this past week, as seen in the table above. In advance of its upcoming 5-to-1 stock split (announced last week on Tuesday, August 11, 2020) which will occur on Monday, August 31, 2020, Tesla closed at an astounding $2,049.98 per share on Friday, August 21, 2020. Tesla has had two consecutive quarters of profitability. The stock may be added into the S&P 500 Index soon, which has resulted in strong buying by investment professionals.

Tesla may, in the near future, benefit from the demand for more electric vehicles in China plus the presence of the Tesla Gigafactory 3 in Shanghai, China. Aside from investment professionals buying the stock aggressively due to the positive information noted here, day-trading individuals on the Robinhood also have been buying the stock voraciously.

Keywords – Tesla, Inc., Tesla, TSLA, Elon Musk, automobile, auto, car, electric vehicle, EV, vehicle, production, Tesla Gigafactory 3, Shanghai, China, Robinhood, 2020.

Disclosure – The principals and clients of Ambastha Financial LLC do not have any positions in TSLA.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.