By Kuldip K. Ambastha

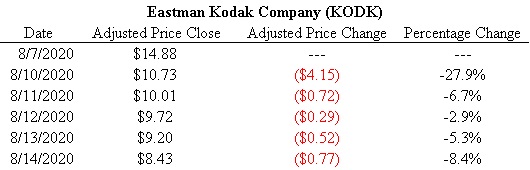

Eastman Kodak Company (KODK) was prominent in the news again this week. During the week of July 27 – 31, 2020, Eastman Kodak Company stock did well because of the news that it received a $765 million American federal government loan, to help in making coronavirus-related drug ingredients. During this week, the company’s stock instead saw consecutive trading days of negative returns due to several negative news items. The initial surge in the stock price triggered several investigations into potential securities law violations (e.g. insider trading) and the stock options given to key company executives in the days right before the loan announcement was officially made.

The company had spent $870,000 to lobby the U.S. Congress and various federal agencies from April – June, 2020. This large lobbying expense was a sharp departure from recent company history. Because of the negative information coming out, the loan was put on hold pending thorough investigations by the U.S. Congress plus the U.S. Securities and Exchange Commission (SEC). For 2Q2020, the company reported a GAAP net loss (-$5 million). Despite the negative returns for the stock seen in every single trading day this week, Robinhood investors are still quite fascinated by this stock.

Keywords – Eastman Kodak Company, KODK, James V. Continenza, COVID-19, coronavirus, pandemic, Robinhood.

Disclosure – The clients and principals of Ambastha Financial LLC do not have any positions in Eastman Kodak Company (KODK).

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.