By Kuldip K. Ambastha

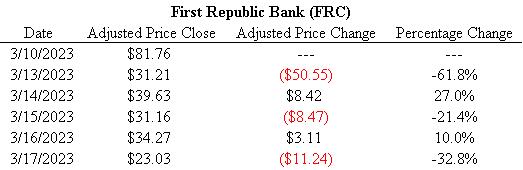

Per the table above, the stock price of First Republic Bank (FRC), a financial institution, had a bumpy ride with three negative and two positive daily returns seen during the trading week. In the recent past, financial institutions have come under investor skepticism related to balance sheet exposures, non-diversified client bases, and other reasons. An alliance of eleven American banks has come together to pledge $30 billion in uninsured deposits so that First Republic Bank can meet client withdrawal requests. First Republic Bank, a regional bank chartered in California, has suspended its cash dividend and is alleged to be in talks to raise more cash through private share sales. It remains to be seen if First Republic Bank will succeed in calming investors.

Keywords – First Republic Bank, First Republic, FRC, financial institution, balance sheet, client base, uninsured, deposits, withdrawals, regional bank, cash dividend, private share sales, calming.

Disclosure – The principals and clients of Ambastha Financial LLC have no positions in FRC.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2023 – Ambastha Financial LLC.

CONTACT US