By Kuldip K. Ambastha

GameStop Corporation (GME), a video game retailer, caught everyone’s attention in this past trading week. Retail investors were bullish about the stock, while institutional investors were bearish about the stock. Like many companies, GameStop has struggled due to the coronavirus pandemic, which led several institutional investors to short the stock. Retail investors observed this trend, and decided to go long the stock instead. Due to the actions of the retail investors, the stock price rose and institutional investors were forced to close out short positions.

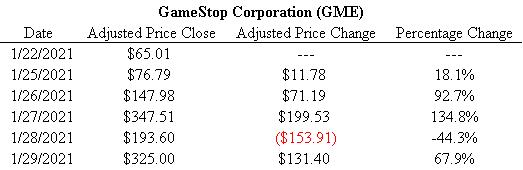

These contrasting theses created a short squeeze of institutional investors and played out to a grand effect, per the table above. The trading activities related to GameStop Corporation were highly volatile, leading to several halts and temporary bans in trading for this stock. A variety of American political, regulatory, and law enforcement bodies will be investigating matters further around what has happened in the GameStop stock’s recent price movements. After findings are eventually released on this front, changes may be seen in the world of investing.

Keywords – GameStop Corporation, GameStop Corp., GameStop, GME, video game, retailer, retail, COVID-19, global, coronavirus, pandemic, institutional, institution, long, short, short squeeze, trading, investing.

Disclosure – The principals and clients of Ambastha Financial LLC have no positions in GME.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2021 – Ambastha Financial LLC.