By Kuldip K. Ambastha

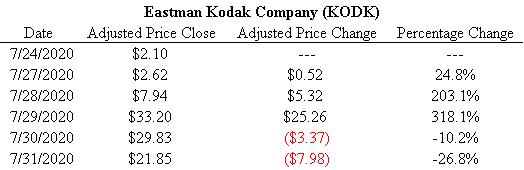

Until recently, Eastman Kodak Company (KODK) had been best known for its famous camera and photography offerings from the past. The company was founded in 1888, in Rochester, New York. With the rise of new technology offerings such as sophisticated smartphone cameras, Eastman Kodak Company was not in the press as much as in the past. However, things changed massively during this week. In particular, people have been speculating on the company’s stock, with significant daily return fluctuations seen per what is in the table above. Aside from James V. Continenza, the Executive Chairman and CEO of the company, seeing his net worth rise because of his 650,000 shares (plus many stock options), individuals have bid up the company’s shares.

Why? Eastman Kodak Company obtained a $765 million American federal government loan to aid in making coronavirus-related drug ingredients. Because of this business line, the company will be creating 360 jobs as part of its effort to help in the pharmaceutical process around the coronavirus pandemic. Many years ago (1988 – 1994), the company had owned an over-the-counter drug business unit (Sterling Winthrop) which was sold to SmithKline Beechman.

Investors of all kinds, professional or not, showed interest in Eastman Kodak Company, especially on Wednesday, July 29, 2020 when trading halts had to be administered 20 times due to stock price volatility. Over the course of the week, more than 63,000 traders on the Robinhood platform were active in the shares of Eastman Kodak Company. It remains to be seen if the company will continue to see strong interest in its shares going forward from investors of all types.

Keywords – Eastman Kodak Company, KODK, James V. Continenza, COVID-19, coronavirus, pandemic, Sterling Winthrop, SmithKline Beechman, Robinhood.

Disclosure – The clients and principals of Ambastha Financial LLC do not have any positions in Eastman Kodak Company (KODK).

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.