By Kuldip K. Ambastha

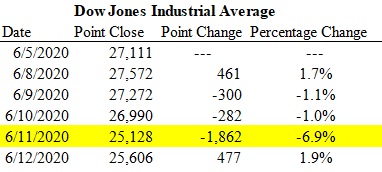

The Dow Jones Industrial Average (DJIA) had a volatile ride this past week, due to several factors. Comments from Jerome Powell (the Chair of the U.S. Federal Reserve), GDP forecasting, unemployment rate (and jobless claims) data, and coronavirus pandemic data all played their own significant parts in the DJIA activity. The day of Thursday, June 11, 2020, is highlighted in the above table because the -6.9% return was the most extreme daily return for the trading week. At a press conference on Wednesday, June 10, 2020, Powell stated that financial conditions are improving, but Fed asset purchases will continue and interest rates will be held in the 0.00% – 0.25% range through at least 2022. His comments point to a gradual recovery for the American economy, with continued potential negative data in terms of real GDP contraction plus an elevated unemployment rate. In 2020, real GDP is expected to decline by 6.5%. At the end of 2020, the unemployment rate is likely to be 9.3%. However, in 2021, real GDP is expected to grow by 5.0% and the unemployment rate is expected to be 6.5%.

Significant inflation is not expected in 2020 and 2021. Unemployment claims for the past week were at 1.5 million, which is 355,000 less than the previous week. Continuing unemployment claims (where people have collected unemployment benefits for at least two consecutive weeks) were 20.9 million, which is 339,000 less than the previous week. Total unemployment claims have fallen for 10 straight weeks, but still the total is very high compared with historical norms. Under a new and temporary Pandemic Unemployment Assistance program from the federal government (for people ineligible to apply for traditional unemployment benefits), 705,676 claims were seen on top of what is noted previously. While the Department of Labor (DOL) has stated that 2.5 million jobs were quite unexpectedly added to the American economy in May 2020, the overall picture still looks quite bleak.

Furthermore, the coronavirus pandemic continues to be an issue affecting the capital markets. In the USA, there are now over 2.0 million total coronavirus cases present, with over 100,000 total deaths related to the coronavirus. States such as New York and California are still being hit hard by the coronavirus. A “second wave” of coronavirus-related deaths may or may not occur in the coming months within the USA as the American people attempt to get back to a “normal” or “new normal” way of living with various restrictions lifted. Given what is described here, the volatility in the DJIA for the past week was justified.

Keywords – U.S. Federal Reserve, Fed, Jerome Powell, coronavirus pandemic, COVID-19, unemployment, jobless claims, Pandemic Unemployment Assistance program, Dow Jones Industrial Average, Dow Jones, DJIA, interest rates, USA, America, American, economy, GDP, inflation, Department of Labor, DOL, New York, California.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.