By Kuldip K. Ambastha

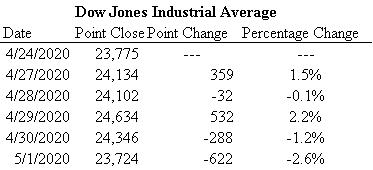

The Dow Jones had three down and two up days this week. The coronavirus pandemic has continued to wreak havoc all around the world, and the American capital markets were affected. During 1Q2020, the USA’s GDP (gross domestic product) annualized contraction rate was 4.8%. This figure was announced on Wednesday, April 29, 2020, and was not surprising given that millions of Americans are unemployed and thousands of businesses across the USA have been closed in full.

Many places within the USA have stay-at-home directives in place, to help stop the spread of the coronavirus. Fear, limits on mobility, and so on made for a drop in consumer spending of 7.6% annualized, a drop in durable goods spending of 16.1% annualized, a drop in services spending of 10.2% annualized, and a drop in business investment of 8.6% annualized. Another 3.8 million people filed for unemployment insurance in the past week for the first time bringing the total job loss number to 30 million, equivalent to about 18% of the American workforce. All jobs created since the Great Recession era of 2008-2009 have now been lost in about 6 weeks. While this negative data was not surprising, the full extent of the damage caused by the coronavirus is still unknown since during 1Q2020, matters started getting much worse in March. Later GDP-related quarterly announcements for 2Q2020 and onwards will likely shed more light on this front.

After the 1Q2020 GDP data was released, the U.S. Federal Reserve (Fed) has stated its commitment to extraordinary emergency steps due to the current turbulence. American interest rates have been lowered to near zero by the Fed, with a target range of 0.00% – 0.25%. The Fed will maintain interest rates at near zero until the economy starts to recover, will be taking aggressive action through emergency lending programs, and is committed to deploying all possible tools to support the American economy.

Keywords – Dow Jones Industrial Average, Dow Jones, DJIA, coronavirus, COVID-19, pandemic, public health, U.S. Federal Reserve, Fed, 1Q2020, interest rates, emergency lending, economics, economy.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.