By Anil K. Ambastha and Kuldip K. Ambastha

Food industry and restaurant industry stocks generally move in a slow and steady manner. Also, once the initial hype is over shortly after an Initial Public Offering (IPO) of a company’s stock, generally, the IPO shares start to decline and, mostly, an IPO’s shares trade for less than the IPO price one year later. However, many strange things can happen in the stock market and are worth paying attention to.

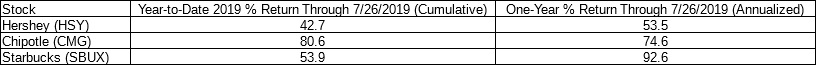

A recent example of an amazing IPO success story in the food industry in 2019 is Beyond Meat (BYND) which has returned 839.6% since its initial IPO price of $25 in early May. The table below notes performance of some of the other notable winners in the food industry and restaurant industry sector this year:

Keywords – Food industry, Restaurant, IPO, Initial Public Offering.

Disclosure – The principals of Ambastha Financial LLC have short option positions in BYND and HSY. They also have a long equity position in HSY and no current positions in CMG and SBUX.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2019 – Ambastha Financial LLC.