By Kuldip K. Ambastha

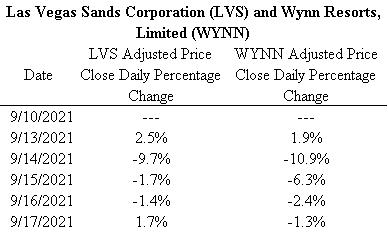

During this past trading week, stocks in the casino sector suffered greatly. After positive daily returns on Monday, September 13, negative daily returns were mostly seen for the rest of the trading week for Las Vegas Sands Corporation (LVS) and Wynn Resorts, Limited (WYNN) per the table seen above (except for a positive daily return for Las Vegas Sands Corporation on Friday, September 17). The worst daily returns of the trading week for these two companies were seen on Tuesday, September 14.

Why the negative returns? Macau is considered the casino capital of China. As a special administrative region (SAR) of China, Macau is the only part of China in which the presence of casinos is legal. The Chinese Communist Party (CCP) is considering regulatory changes which may vastly alter Macau, where currently gambling-related tourism drives about 50% of revenues seen in Macau on an annual basis. On Tuesday, September 14, government officials announced that a 45-day public consultation period will happen, after which new, tighter regulations on gambling will be announced, in line with Chinese authorities cracking down on private businesses overall in the recent past. Aside from public health risks due to COVID-19 making in-person gambling at casinos potentially dangerous to human beings, regulatory risks may hit Macau’s economy hard when officials examine the number of gambling licenses issued, the duration of gambling licenses, a tougher approach towards approving casino operators, and the welfare of employees, among other areas of concern. Also, the government may try to promote and shift resources towards companies in non-gambling sectors, to lessen the reliance of Macau on revenues linked to gambling.

Regulatory risks can be a concern in any sector and for any particular company. Large companies like Las Vegas Sands Corporation and Wynn Resorts, Limited are not immune to these regulatory risks. On one hand in the future, more positive CCP overtures related to casinos may drive positive daily returns for these stocks. On the other hand in the future, more negative CCP overtures related to casinos may drive continued negative daily returns for these stocks. The end result of casino reform in Macau at the moment is uncertain, but Wall Street investors are certainly concerned about this regulatory matter currently.

Keywords – Las Vegas Sands Corporation, Las Vegas Sands, LVS, Wynn Resorts, Limited, Wynn Resorts, WYNN, casino, gambling, economy, revenues, China, Chinese Communist Party, CCP, Macau, special administrative region, SAR, regulation, reform.

Disclosure – The principals and clients of Ambastha Financial LLC have no positions in LVS or WYNN.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2021 – Ambastha Financial LLC.