By Kuldip K. Ambastha

Jerome Powell, the Chair of the U.S. Federal Reserve, issued detailed comments this week. The American economy continues to be ravaged by the coronavirus pandemic. Additional fiscal support aid (e.g. another round of stimulus payments to Americans) will likely be needed for the American economy to recover. However, the Fed is not considering the use of negative interest rates at this time. The use of negative interest rates would be a highly unorthodox monetary policy tool in the USA.

Interest rate fluctuations, bond purchases, and forward guidance (commentary) are the standard tools of the Fed being used right now. The Fed funds rate range is 0% – 0.25% at the moment. Japan along with many countries in Europe have instituted negative interest rates and negative yields for the full duration curve range of their government bonds. Those countries were slowing before the coronavirus pandemic, and are continuing to struggle now during the coronavirus pandemic.

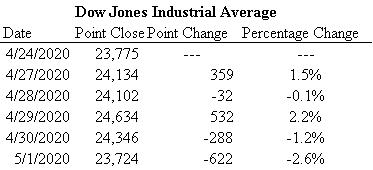

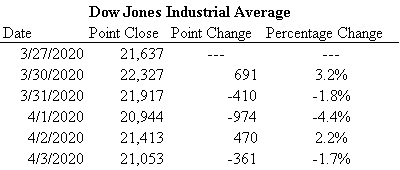

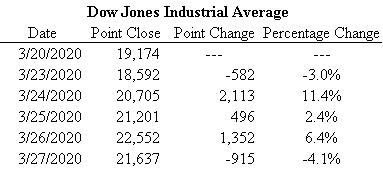

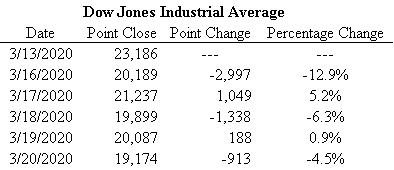

The capital markets reacted negatively to the comments made by Jerome Powell this week. As long as an end to the coronavirus pandemic is not in sight, the American economy will be under duress.

Keywords – U.S. Federal Reserve, Fed, Jerome Powell, American, economic, COVID-19, coronavirus, pandemic, fiscal, monetary, aid, stimulus, economy, negative interest rates, Fed funds rate, Japan, Europe.

Disclaimer – No recommendations are being made via this post. Past performance is not an indicator of future performance. As an investor, you should do your own research and seek professional advice from a Registered Investment Adviser (RIA). You can lose money by investing in stocks and other instruments. Ambastha Financial LLC does not assume any responsibility (legal or otherwise) for any losses that may occur as a result of actions taken based on this post. All content copyrighted © 2020 – Ambastha Financial LLC.